Learn More

Learn More

Corporate Tax in UAE

The UAE will introduce a federal Corporate Tax on business profits effective for financial years starting on or after 1 June 2023. The UAE Corporate Tax regime has been designed to incorporate best practices globally and minimize the compliance burden for UAE businesses. Federal Tax Authority will be the administrative authority for UAE Corporate Tax.

When Will the UAE Corporate Tax will be effective?

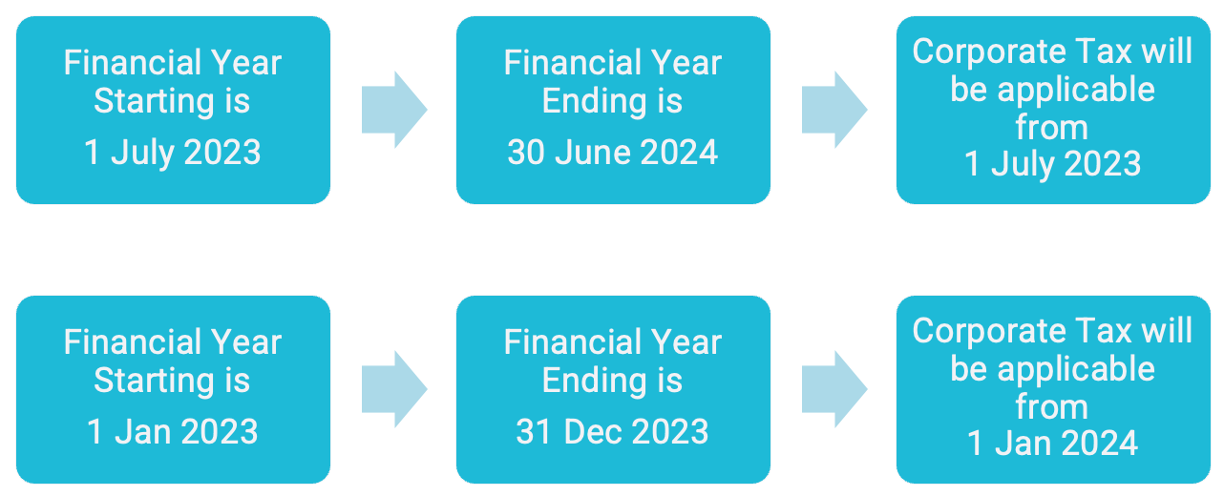

The UAE CT regime will become effective for financial years starting on or after 1 June 2023.

What is UAE Corporate Tax All About?

Corporate tax is a tax levied on the income or profits of a corporation or other legal entity. The rate of corporate tax varies from country to country, and may be as high as 35% in some jurisdictions. In the United Arab Emirates, the corporate tax rate will be 9% for most of the organizations. The UAE’s 9% corporate tax rate applies to both local and foreign companies. However, there are a number of exemptions and reductions that may apply in certain circumstances. For example, foreign branches of local companies may be eligible for a tax credit with regards to corporate tax paid in foreign jurisdiction if there is a Double Taxation Avoidance Agreement between UAE and the respective foreign country. In addition to corporate income tax, businesses in the UAE are also subject to value-added tax (VAT). The standard VAT rate in the UAE is 5%, but certain items are exempt from VAT or subject to a zero-rate.

The Corporate Tax System in UAE

The corporate tax system in UAE is a complex one, with different rates and allowances for different types of businesses. The basic corporate tax rate is 20 percent, but there are a number of different taxes that can be applied to businesses, depending on their size and type. Exemptions and deductions are available for certain types of businesses, such as those involved in agriculture or fishing, or those engaged in export activities. There are also special rates for oil and gas companies operating in the UAE. In addition to the corporate tax, businesses in UAE must also pay value-added tax (VAT) at a rate of 5 percent on most goods and services. VAT is not levied on exports or on certain essential items such as food and medicine.

The Advantages of Corporate Tax in UAE

There are many advantages of corporate tax in UAE. One of the main advantages is that it provides a level playing field for businesses operating in the country. Corporate tax also helps to attract foreign investment into the UAE, as well as encourage businesses to set up operations in the country. Another advantage of corporate tax in UAE is that it helps to create jobs and spur economic growth. By encouraging businesses to set up operations in the country, corporate tax helps to create employment opportunities for locals. In addition, corporate tax also helps to finance vital infrastructure projects such as roads, bridges and airports, which further boosts economic activity. Finally, corporate taxation in UAE helps to generate revenue for the government which can be used to fund public services such as education and healthcare. It also provides an important source of income for the country’s economy as a whole.

The Different Types of Taxes in UAE

There are two types of taxes in the United Arab Emirates: federal and local. The federal government levies taxes on income, profits, and capital gains, while each emirate has its own taxation system for corporations. In addition to corporate taxes, businesses must also pay value-added tax (VAT) on their products and services. The current VAT rate in the UAE is 5 percent.

Conclusion

The UAE has a very attractive corporate tax regime, which is one of the main reasons why so many businesses choose to set up here. There are a number of different benefits that businesses can take advantage of, including low tax rates, exemption from customs duty and many more.

Next Steps

Every business needs to get ready for corporate tax. At Lynchpin Consulting, we have a dedicated team to help you get ready for UAE Corporate Tax in an efficient manner. We have devised Corporate Tax Implementation plans which covers:

Business Impact assessment for Corporate Taxes in UAE

Changes to be made in your Accounting System to incorporate the changes proposed in Corporate Tax

Training your staff on all business scenerios arising once Corporate Tax is implemented

Structural changes in business that could benefit in tax savings e.g. splitting business between free zone and mainland companies

You can always get it in touch with our Corporate Tax Team in UAE.

WHY CHOOSE US FOR UAE CORPORATE TAX CONSULTING?

Dedicated Corporate Tax Team Lead by Tax Experts

You will be safe hands. We have in-house tax experts who can guide you at every stage of getting ready for UAE Corporate Tax

Approachable Tax Services

The best thing while working with Lynchpin for your Corporate Tax requirements is that our team is always approachable. There are no long chain of commands to get access to the Tax Partner.

Tax Planning at Every Step

We are always keen to save you tax with effective tax planning which is well within the UAE Corporate Tax Laws and regulations.

Robust Tax Reporting

We have UAE specific Accounting Software that product real-time and robust tax reporting. This effective takes out the surprises from your tax planning outcomes.

Regular Staff Training

Our in-house Corporate Tax Trainers provide effective and updated tax trainings throughout the year. This important benefit will keep your team up to date with Tax.

Industry Specific Tax Solutions

Corporate Tax is not one-size-fits-all. Every industry has different tax implications. We have in-house industry specific tax expertise.